Zomato Today: Current zomato share price, Trends, and Market Outlook

Updated on : 07 January, 2025

Image Source: tosshub.com

Zomato is a leading name in India’s food-tech industry, celebrated for its innovative services and consistent expansion in the food delivery, dining, and quick-commerce sectors. Emerging as a global brand, Zomato has set benchmarks in customer experience and operational efficiency, making it a cornerstone of the digital economy.

- Founded in 2008, Zomato has grown into a global food-tech powerhouse, serving millions of customers across continents with a strong presence in food delivery, restaurant discovery, and cloud kitchens.

- Zomato’s ability to navigate competitive markets with strategic partnerships and acquisitions, such as the integration of Blinkit for quick-commerce, has strengthened its portfolio and diversified its offerings.

- Recognized for its market dominance and visionary leadership, Zomato continues to drive transformation in the food-tech ecosystem, offering unparalleled convenience and setting new standards in service excellence.

Introduction to Zomato

Zomato is a trailblazing Indian company renowned for its innovative solutions in food delivery, restaurant discovery, and quick-commerce services. With a commitment to enhancing customer experiences and leveraging cutting-edge technology, Zomato has become a household name in the food-tech industry.

- Zomato’s rapid growth and expansion across global markets, combined with its strategic acquisitions and innovations, have positioned it as a leader in the digital economy. Its ability to adapt to changing consumer needs and introduce advanced solutions has made it a pioneer in the industry.

- The company’s zomato share price is a hot topic in the market, reflecting strong investor interest driven by Zomato’s robust performance, growing customer base, and vision for sustainable and tech-driven growth in an ever-competitive landscape.

- Rising through the ranks of the food-tech industry, Zomato has showcased its potential by offering innovative solutions in food delivery, restaurant discovery, and quick-commerce services, earning widespread recognition for its customer-first approach and technological advancements.

- Established in 2008, Zomato has consistently demonstrated its ability to scale and adapt, expanding its reach globally and positioning itself as a leader in the digital food services market. Its continued focus on innovation and service excellence has cemented its reputation as one of India’s leading tech-driven companies.

- Zomato's journey reflects resilience and innovation, earning it global recognition and making it a key player in the future of food-tech. Its ability to thrive in a competitive market and consistently deliver growth has solidified its position as an industry leader with immense potential.

Image Source: inc42.com

Founder of Zomato

Deepinder Goyal: The Visionary CEO Behind Zomato's Rise in Food-Tech Zomato, one of India’s leading food-tech companies, owes much of its success to its visionary CEO, Deepinder Goyal. Founded in 2008, Zomato began as a simple idea to digitize restaurant menus, which quickly grew into a global platform for food delivery, restaurant discovery, and more. Deepinder’s journey began with his experience at Bain & Company, where he identified the lack of online restaurant information and decided to create a solution. This led to the birth of Foodiebay, later rebranded as Zomato.

- The Rise of Food-Tech Under Deepinder’s leadership, Zomato rapidly expanded beyond restaurant reviews and menus, eventually becoming a global leader in the food-tech industry. By focusing on innovation, user experience, and market expansion, Zomato revolutionized the way people ordered food and discovered dining options. Its entry into food delivery and quick-commerce services further solidified its position as a tech-driven pioneer in the food industry.

- Beyond Business Deepinder’s vision extends beyond business growth. Zomato’s social initiatives, such as Zomato Feeding India, showcase his commitment to giving back to society. His dedication to sustainability and creating positive change, alongside the company’s focus on improving customer experience, has shaped Zomato into more than just a business—it's a brand with a purpose.

Today, Zomato’s journey is a testament to how innovation and perseverance can drive growth in a competitive market, positioning the company as a key player in the future of food-tech.

Recent Performance of Zomato Shares

Zomato's zomato share price Trends:

- Zomato's zomato share price has shown significant volatility in recent months, with notable fluctuations reflecting market sentiment and investor confidence in the company’s current price performance.

- As of early 2025, the zomato share price saw a dip, but it continues to attract investor interest due to its growth potential in the global food-tech market.

CEO Deepinder Goyal's Leadership:

- CEO Deepinder Goyal has effectively navigated Zomato through market challenges with a focus on sustainable growth.

- Under his leadership, Zomato has expanded into new markets and introduced services like Zomato Pro and Zomato Gold.

- Deepinder has prioritized customer experience and technological innovation to stay ahead in the competitive food-tech industry.

- Despite setbacks, Deepinder Goyal’s vision remains clear: to make Zomato a global leader in food-tech with a long-term strategy.

Performance and Milestones:

Deepinder Goyal’s leadership has driven Zomato to reach significant milestones, with global expansion and strategic partnerships boosting its growth. His innovative strategies have garnered industry recognition, solidifying Zomato's status as a top player in the food-tech industry.

Popular Blogs

Zomato in News

- Current zomato share price Trends: Zomato's zomato share price has been under scrutiny, with fluctuations driven by market sentiment and overall performance in the food delivery sector. Investors, keen on analyzing the news, are closely tracking these trends to assess potential investment opportunities, particularly as Deepinder Goyal continues to lead the company's expansion strategy.

- Financial Performance Reports: Recent financial reports highlight Zomato's ongoing efforts to improve profitability and operational efficiency. Analysts are closely following the implications of these results, especially as Zomato, under the leadership of Deepinder Goyal, works to enhance its financial performance and drive stock growth.

- Market Positioning: Zomato is navigating a competitive landscape against other food delivery platforms, impacting its market share and, in turn, its zomato share price history. Deepinder Goyal’s strategic initiatives, focusing on customer experience and expanding service offerings, remain critical for the company's positioning in the market.

| Date | Price | Open | High | Low | Vol. | Change % |

|---|---|---|---|---|---|---|

| Jan 07, 2025 | 255.55 | 256.15 | 257.25 | 251.65 | 67.13M | -3.51% |

| Jan 06, 2025 | 264.85 | 274.50 | 274.80 | 262.20 | 52.25M | -2.93% |

| Jan 03, 2025 | 272.85 | 285.00 | 285.00 | 271.50 | 48.24M | -4.13% |

| Jan 02, 2025 | 284.60 | 277.90 | 286.00 | 276.00 | 27.95M | +2.93% |

| Jan 01, 2025 | 276.50 | 279.00 | 279.10 | 276.00 | 14.42M | -0.56% |

| Dec 31, 2024 | 278.05 | 278.00 | 281.60 | 275.00 | 31.93M | -1.44% |

| Dec 30, 2024 | 282.10 | 271.25 | 291.60 | 269.80 | 143.57M | +4.00% |

| Dec 27, 2024 | 271.25 | 274.90 | 275.90 | 269.75 | 19.00M | -0.71% |

| Dec 26, 2024 | 273.20 | 276.60 | 276.80 | 271.25 | 26.03M | -0.60% |

Historical Overview

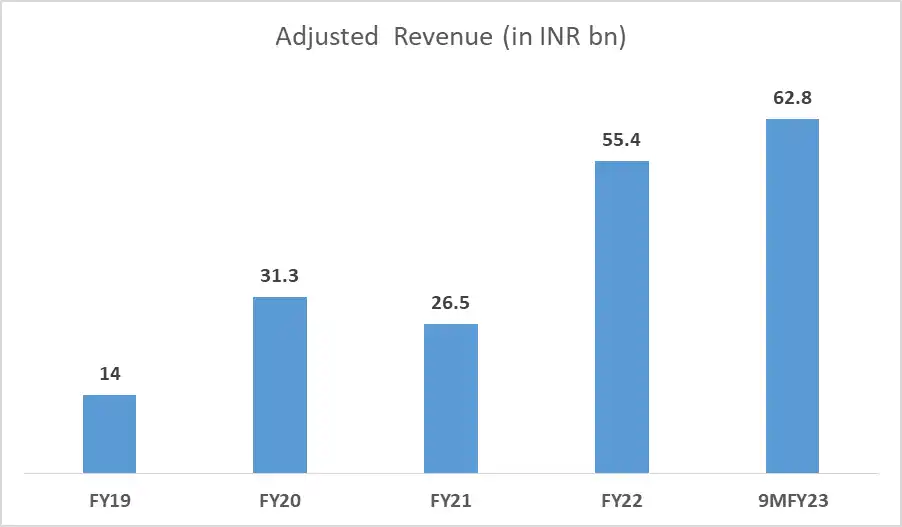

Image Source: equentis.com

Zomato’s stock journey has been notable since its public debut, reflecting both its rapid growth and challenges in the competitive food-tech industry. Here’s a brief historical data overview of Zomato’s zomato share price performance.

Initial Public Offering (IPO)

- Date: July 23, 2021

- Offer Price: ₹76 per share

- Zomato went public with a much-anticipated IPO in July 2021, raising over ₹9,000 crore. The IPO was highly subscribed, with strong market demand, and Zomato's shares listed at a premium.

Initial Surge

- Following its IPO, Zomato's shares saw an immediate uptick, with the stock reaching ₹138 per share on the first day of listing, an increase of nearly 80% from its issue price. This strong debut captured the excitement around India's food delivery sector.

Recent Performance

- The Zomato stock has witnessed both positive and negative phases, with significant ups and downs. Key events, like quarterly earnings reports and market reactions to new business strategies, have had a direct impact on its zomato share price.

- For example, in early January 2025, the stock saw a decline due to market sentiment, but its one-year returns remained strong, reflecting investor confidence in the long-term potential.

Factors Influencing Zomato’s share price

Zomato's zomato share price is influenced by both internal and external factors, as well as broader macroeconomic trends. Understanding these elements can help investors make informed decisions.

Internal Factors

- Financial Performance: Zomato's stock price is heavily influenced by its earnings and profitability. Strong financial results and growth projections boost investor confidence, while weak earnings can lead to a decline.

- Acquisitions: Acquisitions like Blinkit (formerly Grofers) help Zomato expand its market reach and diversify its business, often resulting in a positive impact on its stock price.

- Innovations: Zomato’s innovations, such as Zomato Pro and Zomato Gold, improve customer experience and keep the company competitive, which positively affects its zomato share price.

External Factors

- Competition: Zomato faces strong competition from platforms like Swiggy, which can impact market share and stock performance. Innovation and differentiation are key to maintaining its position.

- Regulatory Changes: Government regulations, such as taxes and labor laws, can significantly impact Zomato’s operations and stock price, either supporting or hindering growth.

- Market Sentiment: Market sentiment toward the food-tech sector influences Zomato’s zomato share price. Positive sentiment can boost stock prices, while negative sentiment can lead to a decline.

Macroeconomic Trends

- Economic Conditions: Macroeconomic factors like inflation or recessions affect consumer behavior, potentially reducing demand for food delivery during tough economic times.

- Consumer Spending: Higher disposable income leads to increased demand for food delivery services, positively impacting Zomato’s revenue and stock price.

- Technological Advancements: Adopting new technologies in logistics and payments can improve efficiency and customer experience, strengthening Zomato’s position in the market.

Competitor Analysis

- zomato share price Comparison: Zomato’s zomato share price performance is often compared with key competitors like Swiggy in India and global food delivery giants such as DoorDash and Uber Eats. The price trends of these competitors provide insights into the competitive dynamics in the food delivery sector.

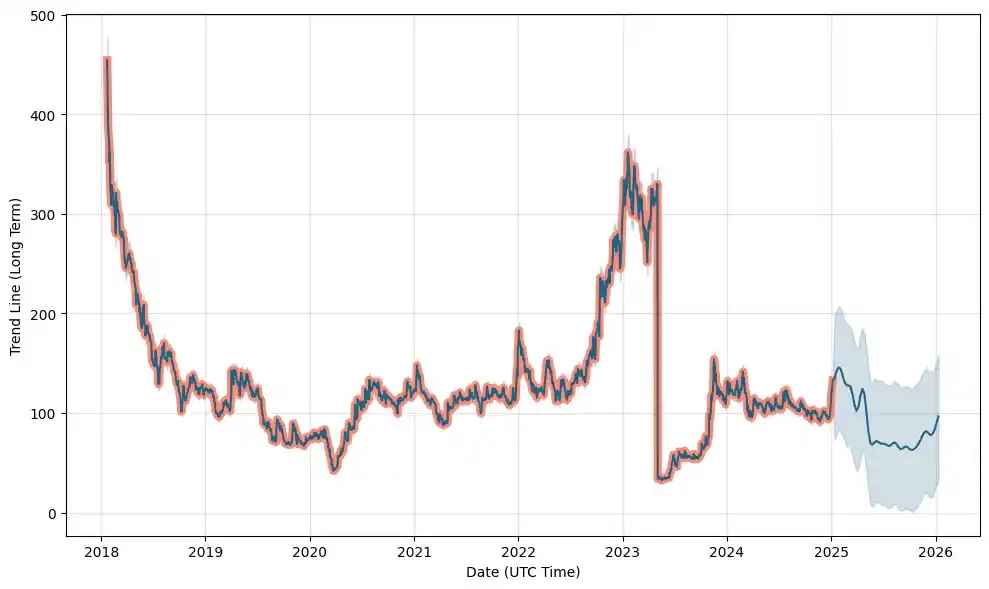

Image Source: walletinvestorstorage.b-cdn.net

- Zomato's Market Position: Zomato holds a strong position in the Indian food delivery market, Zomato competing with Swiggy for market share. On a global scale, it faces competition from established players like DoorDash and Uber Eats. Zomato differentiates itself with local expertise, an extensive restaurant network, and innovative features such as Zomato Pro and Zomato Gold, giving it an edge in a crowded market.

| Category | Zomato | Swiggy |

|---|---|---|

| Market Reach | Available in 500+ cities in India and internationally (UAE, Philippines, etc). | Primarily India, with limited international presence. |

| Product Offering | Food delivery, dining-out, reviews, Zomato Pro/Gold. | Mainly food delivery, with Swiggy Instamart for groceries. |

| Technology & Innovation | AI-based delivery optimization and tech-driven restaurant services. | Focuses on delivery logistics and Instamart, less tech diversity. |

| Brand Recognition | Strong brand, especially in food-tech and restaurant reviews. | Strong in food delivery, but less dominant in reviews and dining. |

| Financial Performance | Growth through acquisitions and product innovations. | Steady growth, but faces profitability challenges. |

| Strategic Partnerships | Acquisitions like Blinkit (Grofers), loyalty programs. | Fewer acquisitions, but has some strategic partnerships. |

| Customer Experience | Zomato Pro/Gold boosts customer loyalty for dining and food orders. | Swiggy offers loyalty programs but lacks dining-related benefits. |

| Delivery Efficiency | Optimized delivery with AI and tech solutions for speed. | Strong delivery network, but lacks AI-driven optimization. |

| Sustainability Initiatives | Investing in eco-friendly practices and reducing plastic. | Has started sustainability efforts, but Zomato is ahead. |

Investor Sentiment

Image Source: media.assettype.com

Price Targets: Brokerage firms have set varied price targets, often influenced by Zomato’s quarterly financial results, market conditions, and sectoral performance. Targets typically reflect optimism over its long-term potential while accounting for short-term challenges.

Analysts and Investors’ Perspective:

- Growth Prospects: Analysts acknowledge Zomato’s robust growth trajectory, driven by expanding market reach, acquisitions, and tech innovations. Investors are optimistic about its ability to dominate the food delivery and quick-commerce segments.

- Profitability Concerns: While the company has shown improvements in reducing losses, analysts highlight the need for consistent profitability to sustain long-term investor confidence.

Key Brokerage Ratings:

- Positive Ratings: Several brokerage firms maintain a "Buy" rating, citing Zomato’s market leadership, strategic acquisitions like Blinkit, and strong operational metrics.

- Neutral or Hold Ratings: Some firms suggest caution due to intense competition, cash burn concerns, and regulatory uncertainties.

Opportunities and Challenges

Opportunities:

- Expansion: Zomato has significant room to grow by expanding into tier-2 and tier-3 cities and strengthening its international presence in untapped markets.

- New Products: The launch of innovative services like quick commerce, subscription programs (Zomato Gold), and technology-driven solutions provides avenues for revenue diversification.

- Partnerships: Strategic collaborations with restaurants, logistics providers, and payment platforms can further enhance its ecosystem and boost market share.

Challenges:

- Profitability Concerns: Despite growth, achieving sustainable profitability remains a critical challenge as the company navigates high operational costs and competitive pricing strategies.

- Competition: Intense rivalry from players like Swiggy and international platforms requires continuous innovation to maintain a competitive edge.

- Regulatory Hurdles: Government policies, taxation changes, and labor law regulations could affect operational efficiency and cost structures.

Future Outlook

Zomato's future outlook focuses on its growth potential, driven by market expansion, new innovations, and strategic partnerships. Key factors include zomato share price predictions based on trends, opportunities for growth, and risks like competition and regulatory challenges. It reflects Zomato’s potential to sustain growth and lead in the food-tech industry.

- Predictions for zomato share price:

- Zomato's zomato share price is likely to be influenced by growth in the food delivery industry, expansion into tier-2 and tier-3 cities, and global operations.

- Positive market trends and continued revenue growth could lead to steady stock appreciation.

- However, fluctuations due to broader market volatility and profitability concerns remain possible.

- Potential Catalysts for Growth:

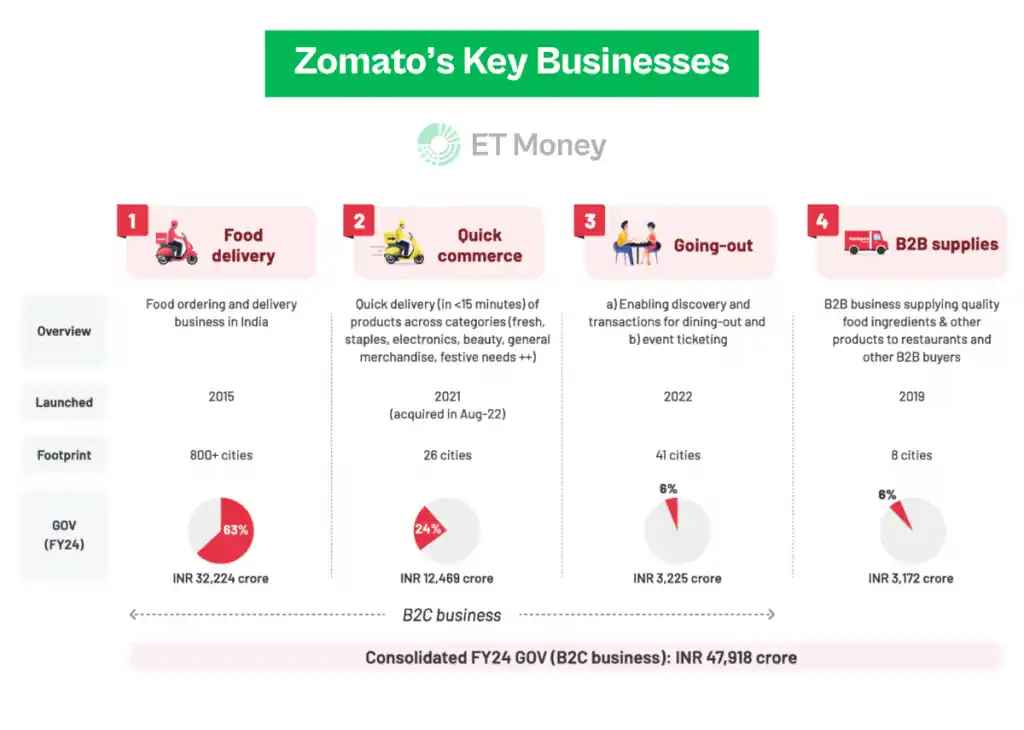

Image Source: cdnlearnblog.etmoney.com

- New Revenue Streams expansion into quick commerce (Blinkit) and subscription programs like Zomato Gold.

- Market Expansion tapping into underserved regions and international markets.

- Technological Advancements continued innovation in delivery logistics and customer engagement tools.

- Partnerships and Acquisitions strategic collaborations to strengthen its ecosystem and diversify offerings.

Investment Strategies

Growth vs. Value Investors:

- Growth Investors: Zomato appeals more to growth investors due to its focus on scaling operations, expanding into new markets, and driving innovation. The company is investing heavily in technology, acquisitions like Blinkit, and diversifying its offerings to capture future market potential.

- Value Investors: Traditional value investors may find Zomato less attractive at this stage, given its ongoing struggle for profitability and relatively high valuation compared to its earnings.

Long-Term vs. Short-Term Investment Potential:

- Long-Term Potential: Zomato’s long-term growth prospects are promising for those who believe in the growing food delivery and quick commerce sectors. Its efforts to achieve profitability, expand internationally, and introduce innovative services could yield significant returns for patient investors.

- Short-Term Potential: For short-term investors, Zomato's stock may be volatile, influenced by quarterly earnings, market sentiment, and news around competition or regulations. Short-term trades might benefit from market corrections or positive developments but carry higher risk.

Key Takeaways for Investors

Image Source: tosshub.com

Zomato as a Long-Term Investment:

- Zomato has positioned itself as a leader in the food delivery and dining space, supported by its strong brand recognition and diverse product offerings.

- Its efforts in expanding to international markets, introducing innovative features like Zomato Gold and Blinkit for quick commerce, and leveraging technology for operational efficiency indicate strong long term investment growth potential.

- For investors seeking exposure to the fast-growing food-tech sector, Zomato presents a compelling case for long-term value creation.

Risks to Consider:

- Profitability Concerns Zomato is still working toward sustained profitability, with high operational costs and investments in new ventures.

- Intense Competition Rivals like Swiggy and global players in the food-tech space pose a constant challenge to market share and growth.

- Regulatory Changes in taxation, labor laws, or delivery norms could impact the company’s operations and profitability.

- Market Volatility being a tech-driven platform, Zomato’s stock can be sensitive to broader market sentiment, particularly in the startup and technology sectors.

Conclusion

Zomato has a positive outlook with a "Buy" consensus from analysts and an average target price of ₹125, indicating a potential upside of approximately 18%. The company is demonstrating strong growth potential, driven by its expanding market presence, strategic acquisitions like Blinkit, and continuous product innovation. Zomato's focus on achieving profitability and capitalizing on the growing food delivery and quick commerce sectors positions it well for sustained growth in the coming years.

Zomato's stock has faced some volatility, with a recent decline of 3.51%, opening at ₹255.55 on January 7, 2025. However, the company has demonstrated resilience, with a 52-week high of ₹286.00. Over the past month, the zomato share price has grown by 15.6%, reflecting strong market optimism. With annual revenue and earnings growth projections of 22% and 27%, respectively, Zomato is well-positioned to continue its upward trajectory, making it an attractive option for investors seeking long-term growth in the food-tech space.