DMart Shares: An In-Depth Analysis on Whether to Buy, Hold, or Sell

Updated on : 07 January, 2025

)

Image Source: Stock Market

Introduction

Avenue Supermarts Limited, commonly known as DMart, is a prominent player in India's retail sector. Founded by Radhakishan Damani, DMart has carved a niche for itself with its hypermarket format, offering a wide range of products at competitive prices. The company's stock has garnered significant attention from investors due to its consistent performance and growth potential. However, recent fluctuations in share prices and mixed recommendations from analysts have raised questions about the stock's future trajectory. This blog aims to provide an in-depth analysis of DMart's current market performance, financial results, future projections, and the factors influencing its growth.

Overview of Avenue Supermarts Ltd. (DMart)

Founded by Radhakishan Damani, DMart operates a chain of hypermarkets across India. Known for its cost-efficient model and customer-centric approach, DMart remains a prominent player in the Indian retail landscape.

Importance of DMart in the Indian Retail Market

DMart’s widespread presence and operational efficiency make it a go-to retailer for millions of Indian consumers. With a focus on high-turnover items and value-for-money products, DMart has consistently outperformed competitors in revenue and profitability.

Current Market Performance

Recent Share Price Trends

-

As of January 3, 2025, DMart's stock opened at ₹3,840.00, reflecting a notable increase of approximately 14.50% from its previous close of ₹3,611.10. This surge indicates positive market sentiment and investor confidence in the company's operational strategies and financial health. However, despite this recent uptick, DMart shares have experienced considerable volatility over the past month, dropping about 11%.

-

DMart shares have shown resilience amidst market volatility. Recent data highlights an upward trend, with a 4% increase in the past week. Despite challenges, the stock continues to attract both retail and institutional investors.

To check the most up-to-date stock price of DMart (Avenue Supermarts Ltd.), you can refer to the following reliable sources:

Popular Blogs

Analyst Recommendations

The stock's performance has prompted varying recommendations from brokerage firms:

- Centrum Broking: Upgraded DMart to 'Buy' following a price correction and set a revised target price of ₹5,655. You can buy the stock here.

- Motilal Oswal Financial Services (MOFSL): Maintained a 'Hold' recommendation with a revised target price of ₹5,026 due to concerns about competition from online grocery platforms and subdued discretionary spending.

- Antique Stock Broking: Also maintained a 'Hold' recommendation but adjusted its target price downward to ₹5,040 from ₹5,183. These recommendations highlight cautious optimism among analysts regarding DMart's ability to navigate competitive pressures while continuing its expansion strategy.

Target Price Projections

Short-Term and Long-Term Targets

Analysts predict DMart shares to reach ₹4,700 in the short term and ₹5,200 in the long term, driven by robust fundamentals and growth potential. For those interested in purchasing DMart shares, you can buy the stock here.

Recent Share Price Trends

DMart shares have shown resilience amidst market volatility. Recent data highlights an upward trend, with a 4% increase in the past week. Despite challenges, the stock continues to attract both retail and institutional investors.

Volatility and Market Sentiment

Market sentiment around DMart remains optimistic, driven by strong Q2 earnings and an ambitious expansion strategy. However, increasing competition from online grocery platforms poses a challenge.

Financial Performance Overview

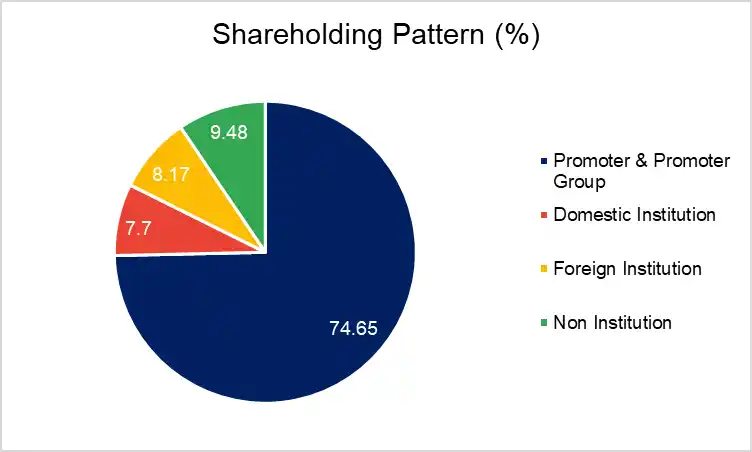

Shareholding Pattern

Image Source: DMart Annual Report

Financials

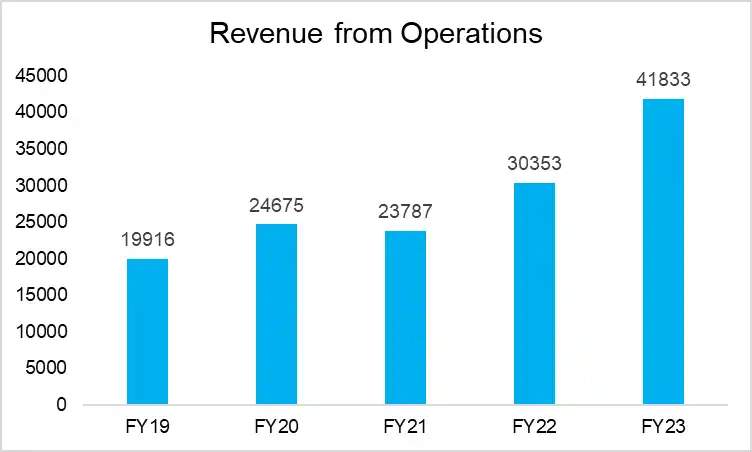

Revenue

In FY23, the company reported a 38% year-on-year increase in consolidated revenue from operations to ₹41,833 crores, from ₹30,353 crores in FY22. In Q1FY24, revenue from operations came in at ₹11,865.44 crores, up 18.2% from ₹10,038.07 crores in Q1FY23.

Image Source: DMart Annual Report

EBITDA

In FY23, the company reported a 46% year-on-year increase in EBITDA to ₹3,659 crores from ₹2,502 crores in FY22. And, in Q1FY24, DMart’s EBITDA was ₹1,035.3 crores, up 2.8% year-on-year, compared to ₹1,008 crores in the same period last year.

| FY19 | FY20 | FY21 | FY22 | FY23 | |

|---|---|---|---|---|---|

| EBITDA Margin (in %) | 8.2 | 8.6 | 7.3 | 8.2 | 8.7 |

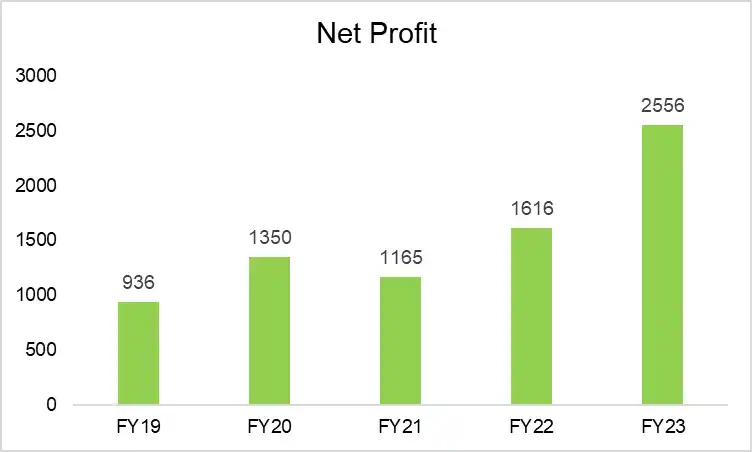

Net Profit

In FY23, the company’s net profit increased by 58% year-on-year to ₹2,556 crores from ₹1,616 crores. And, in Q1FY24, net profit increased by 2.3% to ₹658.71 crores from ₹642.89 crores in Q1FY23.

Image Source: DMart Annual Report

| FY19 | FY20 | FY21 | FY22 | FY23 | |

|---|---|---|---|---|---|

| Net Profit Margin (in %) | 4.7 | 5.5 | 4.9 | 5.3 | 6.1 |

Key Financial Ratios

- Current Ratio: The current ratio increased 4 times at the end of FY23 from 3.06 times in FY22. The ratio increased because fixed deposits held with the bank last year were reclassified as a current asset in FY23.

- Debt-to-equity Ratio: The company has no long-term debt on its book, and the debt-to-equity ratio is stable at 0.03 times as of 31st March 2023.

- Interest Coverage Ratio: The interest coverage ratio was 68.22 times at the end of FY23, up from 56.09 times at the end of FY22.

- Inventory Turnover Ratio: The inventory turnover ratio in FY23 was 14.83 times, up from 12.77 times in FY22.

- Operating Profit Margin: The operating profit margin in FY23 was 7.84%, up from 7.32% in FY22.

- Net Profit Margin: The net profit margin was 6.11% in FY23, up from 5.32% in FY22.

- Return on Capital Employed (ROCE): The ROCE of the company improved to 21.50% at the end of FY23, up from 17.37% at the end of FY22.

- Return on Equity (ROE): The ROE stands at 16.8% in FY23, up from 12.32% at the end of FY22 due to increased earnings.

DMart Share Price Analysis

DMart launched its IPO on March 8th, 2017, and was the most successful issue in the market. The IPO was issued at a price band of ₹295 to ₹299 per share and oversubscribed by 104.5 times, receiving bids for 463.61 crore shares against the total issue size of 4.43 crore. The shares were listed on March 21, 2017, at ₹604.7 per share, up 102% over the issue price.

Image Source: TradingView

In the last five years, DMart share price has given a CAGR return of 20%, rising from around ₹1,200 level, and as of 21st September 2023, it is trading at around ₹3,680 level. It made an all-time high level of ₹5,900 on 18th October 2021.

Avenue Supermarts Company Analysis

- Avenue Supermarts recovered from severe COVID-19 impacts on sales.

- Growth and demand in FY23 have surpassed pre-COVID levels.

- Total Bill Cuts:

- FY23: 25.8 crores

- FY20: 20.1 crores

- FY21: 15.2 crores

- Revenue from Sales Per Retail Business Area (₹/sq ft):

- FY23: ₹31,096

- FY19: ₹35,647 (still higher than FY23)

- During this period, the company expanded to new geographies.

- Store Count:

- Increased from 176 (FY19) to 324 (FY23)

- Retail Business Area:

- Increased from 5.9 million sq. ft. (FY19) to 13.4 million sq. ft. (FY23)

Financial Performance

- Financial Performance in FY23:

- Annual increase in the top line: 38% to ₹42,839.56 crore.

- Bottom line increase: 58% to ₹2,556 crore.

- Net profit margin improved by 210 bps:

- FY21: 4.9%

- FY23: 6.1%

- The company recovered from the Covid-19 pandemic slowdown and drop in demand.

- Challenges:

- General Merchandise and Apparel Category continues to witness sales weakness.

Operational Performance

The company in FY23 added 1.9 million sq ft, and sales revenue inched higher from ₹27,454 per sq. ft. to ₹31,096 per sq. ft. Still, it is below the pre-Covid levels, which used to be ₹35,647 per sq. ft. in FY19.

E-commerce Business

DMart Ready, the company’s e-commerce division, reported a total revenue of ₹2,202.03 crores in FY23, compared to ₹1,667.21 crores in FY22. It reported a loss of ₹193.07 crores and ₹142.07 crores in FY23 and FY22, respectively. The company operates its e-commerce services in 22 cities and focuses on increasing efficiency in the Mumbai Metropolitan Region.

Expansion

- Expansion Strategy:

- The company follows a cluster-based expansion approach:

- Strengthens presence in existing areas before moving to new regions.

- The company follows a cluster-based expansion approach:

- Pharmacy Business Expansion:

- DMart has entered the pharmacy sector with its first outlet in Mumbai.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Revenue Growth Analysis

The company’s focus on Tier 2 and Tier 3 cities has bolstered its growth trajectory. With over 400 stores nationwide, DMart’s strategic expansion into underserved markets has paid dividends.

Recent Earnings Reports

DMart’s Q2 FY25 report highlighted a net profit increase of 18% YoY, reaching ₹640 crore. Analysts attribute this growth to higher footfall and improved inventory turnover.

Analyst Recommendations

Summary of Brokerage Opinions

Leading brokerage firms remain divided on DMart’s valuation. While Citi maintains a ‘Buy’ rating, Morgan Stanley suggests a cautious approach, citing high valuation multiples.

Target Price Projections from Various Analysts

- Citi: ₹5,000 (12-month target)

- Morgan Stanley: ₹4,200 (12-month target)

- HDFC Securities: ₹4,800 (12-month target)

Factors Influencing Share Price

Competitive Landscape

Impact of Online Grocery Platforms

The rise of players like BigBasket and Amazon Fresh has intensified competition in the grocery retail space. DMart’s focus on physical stores remains a key differentiator.

Consumer Behavior Shifts

A gradual shift towards online shopping has prompted DMart to explore its e-commerce platform, DMart Ready, which has seen moderate success.

Expansion Strategy

Planned Store Additions

DMart plans to open 50 new stores in FY25, with a focus on high-density urban areas.

Capital Expenditure Insights

The company has allocated ₹2,500 crore for new store development and technological upgrades.

Economic Conditions

Effects of Economic Fluctuations on Retail Spending

Rising inflation and interest rates could impact discretionary spending, potentially affecting DMart’s revenue in the near term.

Target Price Projections

Short-Term and Long-Term Targets

Analysts predict DMart shares to reach ₹4,700 in the short term and ₹5,200 in the long term, driven by robust fundamentals and growth potential.

Comparative Analysis of Analyst Estimates

While some analysts remain cautious due to high PE ratios, others are optimistic about DMart’s ability to sustain growth in a competitive environment.

Risks and Challenges

Market Competition Risks

Increasing competition from online and offline players could erode DMart’s market share.

Valuation Concerns

DMart’s high valuation multiples (PE of 65x) remain a concern for conservative investors.

Economic Factors Affecting Performance

Fluctuations in commodity prices and economic uncertainty could impact DMart’s profitability.

Conclusion: Is DMart a Good Investment?

Summary of Investment Potential

- Position in the Indian Retail Sector:

- DMart remains a strong contender due to its efficient operations and strategic expansion.

- Outlook:

- Short-term risks persist.

- Long-term outlook remains positive.

Recommendations for Investors

- Buy: For long-term investors focusing on growth.

- Hold: For existing investors looking to ride out market volatility.

- Sell: For those seeking short-term gains or concerned about high valuations.

| Brokerage | Recommendation | Target Price (₹) |

|---|---|---|

| Centrum Broking | Buy | ₹5,655 |

| Motilal Oswal Financial | Hold | ₹5,026 |

| Antique Stock Broking | Hold | ₹5,040 |

| Macquarie | Bearish | ₹3,702 |

| CLSA | Outperform | ₹5,360 |

Final Thoughts

Future Outlook for DMart Shares

With plans to expand its footprint and enhance its e-commerce presence, DMart is well-positioned for sustained growth.

Importance of Monitoring Market Trends and Company Announcements

Investors should keep an eye on quarterly earnings, store additions, and macroeconomic factors to make informed decisions.