CA Exam Results November 2024: Comprehensive Insights

Updated on : 27 December, 2024

Image Source: Getty Images

The Institute of Chartered Accountants of India (ICAI) has officially announced the results for the CA Final examinations conducted in November 2024. This blog provides an in-depth look at the results, including performance statistics, top scorers, and implications for future candidates.

Introduction

The CA Final exam is one of the most rigorous professional examinations in India, serving as a crucial step for aspiring Chartered Accountants. The November 2024 results are significant as they reflect the dedication and hard work of thousands of candidates who have invested years in their studies.

Announcement of Results

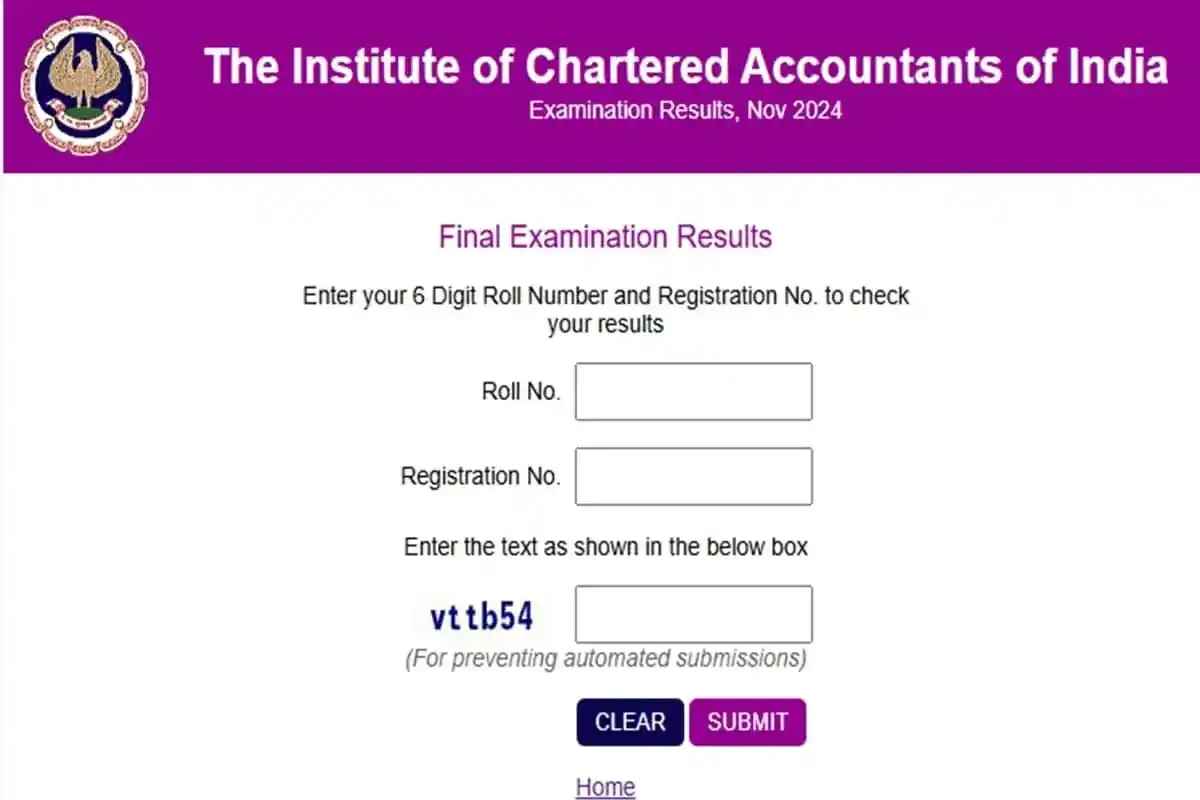

Image Source: Google.com

The ICAI announced the results on December 26, 2024, at 11 PM IST. Candidates could access their scores through the official ICAI websites: icai.org and icai.nic.in. The announcement generated considerable anticipation among approximately 66,987 candidates who appeared for the exams.

Top Performers

This year showcased remarkable achievements among candidates, with several securing outstanding scores:

| Rank | Name | Marks | Percentage |

|---|---|---|---|

| 1 | Heramb Maheshwari | 508 | 84.67% |

| 1 | Rishab Ostwal R | 508 | 84.67% |

| 2 | Riya Kunjankumar Shah | 501 | 83.50% |

| 3 | Kinjal Ajmera | 493 | 82.17% |

Both Heramb Maheshwari and Rishab Ostwal achieved identical scores, making them joint toppers this year.

Overall Performance Statistics

In total, 11,500 candidates successfully qualified as Chartered Accountants this year, reflecting a significant achievement amidst rigorous examination standards.

Key Statistics:

- Total Candidates: 66,987

- Total Qualified: 11,500

- Overall Pass Percentage: Approximately 13.44%

This overall pass percentage indicates the competitive nature of the examination and highlights the need for thorough preparation.

Group-wise Pass Percentage

The pass percentages for each group are broken down as follows:

| Group | Total Candidates Appeared | Total Candidates Passed | Pass Percentage |

|---|---|---|---|

| Group I | 66,987 | 11,253 | 16.8% |

| Group II | 49,459 | 10,566 | 21.36% |

Insights:

- Group II exhibited a higher pass percentage compared to Group I, suggesting that candidates may find the subjects in Group II relatively more manageable or better aligned with their strengths.

- The overall pass percentage of 13.44% is lower than previous years' averages, indicating increased competition and possibly more challenging exam papers.

Detailed Analysis of Pass Rates

The pass rates reveal trends that can be useful for future candidates:

- The pass percentage has seen fluctuations compared to previous years; last year's overall pass rate was around 18%, indicating a more challenging exam this time.

- Candidates who utilized structured study plans and mock tests reported higher success rates.

Recommendations for Future Candidates:

Image Source: Google.com

-

Start Preparation Early: Focus on understanding concepts rather than rote memorization. Early preparation allows ample time to grasp complex topics and reduces last-minute stress.

-

Engage in Peer Study Groups: Collaborating with peers enhances learning through discussion. Study groups can provide different perspectives on difficult topics and foster a supportive environment.

-

Utilize ICAI’s Resources: Make use of ICAI’s official resources, including study materials, webinars, and guidance notes. Additionally, practicing with past exam papers can help familiarize candidates with exam patterns and question formats.

Steps to Check Results

Candidates can check their results by following these simple steps:

- Visit the official ICAI website: icai.org.

- Click on the “Results” tab on the homepage.

- Select "CA Final Result" from the dropdown menu.

- Enter your registration number and roll number.

- Click "Submit" to view your result.

- Download and print your scorecard for future reference.

Implications of the Results

For many candidates, passing the CA Final exam is a gateway to numerous career opportunities in finance, accounting, and consultancy sectors:

- Employment Opportunities: Many multinational corporations actively seek newly qualified Chartered Accountants for roles in auditing, taxation, financial analysis, and advisory services.

- Independent Practice: Successful candidates can start their own practices or join established firms as partners or associates.

- Specialized Fields: There are opportunities to specialize in areas such as forensic accounting, corporate finance, and risk management.

Future Opportunities for Successful Candidates

Successful candidates have various paths they can choose from:

- Corporate Sector: Join companies in roles such as financial analysts or internal auditors.

- Government Services: Apply for positions in government departments that require financial expertise.

- Entrepreneurship: Start their own accounting firms or consultancy services.

- Further Studies: Pursue additional qualifications like an MBA or specialized certifications (e.g., CFA, CIMA).

Feedback from Candidates and Experts

The response from candidates regarding the results has been largely positive among those who passed:

- Many expressed relief and excitement about their future prospects in the accounting profession.

- Some candidates shared their experiences regarding preparation strategies that worked well for them.

Expert Opinions:

Industry experts emphasize the importance of continuous education and staying updated with regulatory changes to remain competitive in the field.

Conclusion

The CA Final Exam results for November 2024 mark not just a personal achievement for many but also contribute to India's growing pool of qualified professionals in finance and accounting. As new Chartered Accountants embark on their careers, they carry with them essential knowledge and skills necessary to navigate complex financial environments effectively.

This year's results reinforce the significance of perseverance and dedication in achieving professional goals within the rigorous field of Chartered Accountancy. For those who did not pass this time, it is essential to learn from this experience and prepare diligently for future attempts.

Congratulations to all successful candidates! Your hard work has paid off, and you are now part of a prestigious profession that plays a vital role in shaping India's economic landscape.